|

|

||||||||

|

|

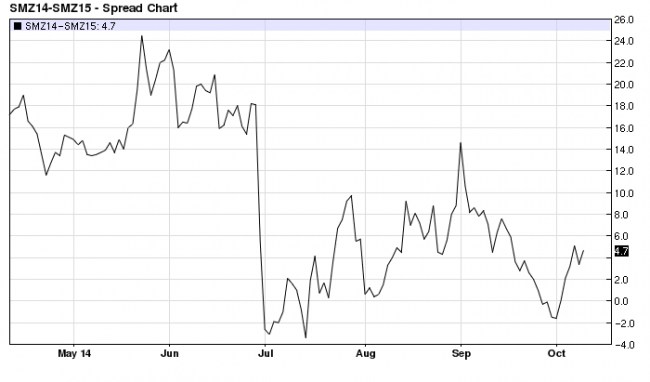

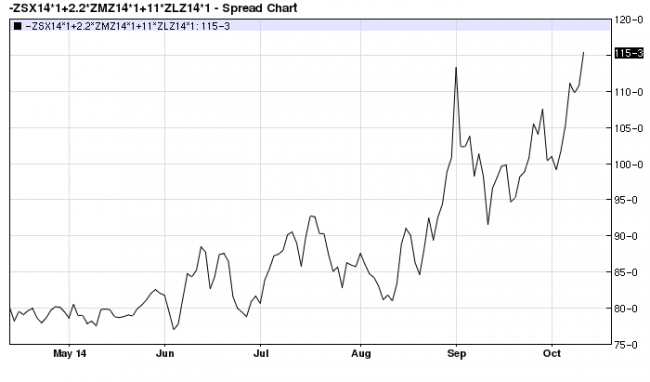

IKAR in Mass MediaWeekly Market Review - Alpine Trading LLC14 октября 2014 года As for the markets, WHEAT The wheat has definitely seen an interesting rally this week (as we were predicting and hoping) but has in the last few days backed up due to news from Europe. The Socomac grain silo, one of the delivery points for the Paris Euronext contract said that they were suspending reception of wheat due to weak export demand and limited storage capacity. Now both delivery locations have stopped taking wheat. This would have an overall bearish effect on the wheat market. However, the USDA monthly report has re-affirmed my forecasts that we were definitely buying demand both domestically and export for the wheat trade at sub-$ 5.00 levels. USDA confirmed a lower carryout for the U.S. at 654 mln bu vs. 698 in Sept. Also, on the world stage, they are forecasting 14/15 carryout at 192.59 mln mt (which implies 26.9 % s/u ratio). This is another confirmation that we have bottomed and heading higher, in my opinion. Overnight, we saw GASC (Egypt) come into the market for mid-November shipment. After the news in France of course, this will be interesting to see who prices the cheapest wheat. It would NOT be any surprise of course if the French market won this tender and we are not sure U.S. will be offered. As of this writing, we have not received confirmation of the business concluded but the cheapest offers look to be French and Russian (2nd place) with no U.S. offers presented. Interesting to note, that French wheat offers this week were higher than last week's by 4-5 usd pmt. Russian wheat export prices fell for the third week straight with Sept grain exports in general falling to 3.75 mln mt vs. record 4.7 mln mt in August. 12.5 pro dry wheat is quoted at 235 pmt usd down a couple of bucks from last week. Russian government approx 26 kmt of intervention stocks this week. However, SovEcon and IKAR are starting to discuss potential issues with Russian wheat seedings for 2015/16 crop due to snow/ rain in some production areas where fall crops are still being harvested. So this could push the dynamic a little bit. IKAR is now cutting their Russian wheat production estimate to 58.5 from previous 60 mln mt. Some areas need rain for seeding, so could be a cut back in acrea in Black Sea production zone for next year. So far, Western Europe is looking good for seeding progress but flat on acreage year to year. Overall, I think that the intervention and uncertainty about seeding in Black Sea zone could help prop the wheat market again some more. Algeria is tendering for 50,000 mt milling wheat Jan/ Feb. Japan also bought 109kmt milling wheat from U.S. and Canada this week. South Korea mills bought 122kmt for optional origin, Can, Aussie, U.S. for Feb thru May shipment periods. Thai millers bought 120kmt of Black Sea wheat at 220 usd pmt from Black Sea origins (no clarification on protein levels but definitely a cheap price). Oman purchased 60kmt cnf $ 265 pmt cnf possibly German origin. Argentina continues to have troubles in political and economic arenas as last week Central Bank governor and Minister of Economy both resigned. The issue of export licenses for wheat is still uncertain and not all exporters are willing to stick their neck out to offer export wheat. That to me is a major development as Latin American buyers including Brazil usually now are looking much more heavily into buying Dec- Feb 15 shipments from Argentina and they can't do that very easily at this point. France Agri Mer raised their 14/15 soft wheat carryout estimate to 4.4 mln from 3.9 mln last month; while corn carryout was reduced by 0.2 mln mt to 3.7 mln mt. France supply glut seems to keep this market from really wanting to rally. Demand driven markets right now are not really volatile, so I think it would take a development in Argentine's political arena and/ or Russian wheat seedings issue to really have this market take off. Spring wheat harvest is at 96 % complete, up 2 % from last week vs. 99 % average. Winter wheat was 56 % planted, up 13 % from last week vs. 53 % avg, and emergence showing a strong 28 %, up 14 % from last week and 24 % average. Canadian harvest also progressing another 10 % probably estimate closer to 90 % complete. We are starting to see more active sellers from Canada for FOB shipments Dec-forward however, cash basis is nearly 100 % of what it was 1 month ago. BOTTOM LINE: I don't see any downside on this wheat market in futures by more than 15-20 cents and with another 80-90 cents upside in the medium term. Cash capacity for export is still scarce. Major Asian buyers are already buying into April/ May; I would recommend doing the same at least into JFM 15. CORN Corn harvest showing still very good yields out there. Harvest right now at 17 % complete vs. 12 % last week, and 32 % average. Wet weather continues to slow harvest progress in the Delta and southern part of the Midwest. We probably will continue with wet weather until early next week, when things finally clear and harvest could progress better. Right now, the slow harvest is catching the market off guard. USDA monthly report showing 2.081 bln bu carryout confirmed this month. That's huge no matter how you look at it. Ending stocks on world levels still increasing to 190.58 mln mt or 19.58 % s/u ratio (VS. 9 % and 7 % respectively in the last 2 years). Don't see anything bullish here, probably will gravitate toward $ 3.20 then $ 3.00 in the coming weeks hopefully once we get combines rolling and harvest ramped up again. Export sales this week were also very good at 785kmt vs. 550-750k expectations despite good competition in the world from Ukraine and South American origins still. Still we see corn business done to traditional destinations like Japan, Peru and Mexico. Big corn sales this morning reported for 14/15 at 1.478 MMT to our neighbors down South. Cash corn markets are significantly under pressure with CIF nearby bid at +35-40 levels (FH Nov cif bids 30 cents higher) as farmers selling $ 3.00 corn net to them with big yields (200-250 bpa plus), makes sense to do so instead of selling beans which don't give such a good return even at $ 9.25 ex-farm. Corn export program is not as strong in the U.S. as the bean and meal program is given that South America is absent right now for beans/ meal AND U.S. corn market has many competitors and ethanol market is down 25 % in 1 month. There are reports that China booked 2 mln mt with Ukraine as part of the new loan agreement that had been reached last year. This could be very interesting as most were thinking that China would stay away from importing corn completely (last year U.S. commits at 3.6 mln mt this time while right now at 70,000 mt). Of course, they have been a steady buyer of U.S. milo, with 2.2 mln mt commits this year vs. 425k mt last year. Right now, EU and Black Sea need all the feed wheat and feed grain business that they can get so not sure it is the most bullish thing out there. US Fob values are showing $ 2 pmt premium to Brazil and $ 6 pmt prem to Ukraine for November, but as you go out to Dec/ Jan, the origin spreads narrow quite a bit. Safras came out with their corn 14/15 production estimates for Brazil being between 76.6 and 78.9 mln mt vs. USDA 75 mln mt. with acreage estimated down as much as 3-5 %, with the biggest decreases coming from the southern states of Sao Paulo, Parana, Minas Gerais, and Rio Grande. To compare this Safras is estimating soybean acreage and production for 14/15 to be up in Brazil between 89-92.4 mln mt. BOTTON LINE: I still believe that the corn futures market is still heading down on the medium term towards $ 3.00. This is probably where we will see bigger support than $ 3.40, so I would not be a flat price buyer here. Spring spreads in corn for 2015 look attractive. Be very diligent about getting cash coverage for OND and JFM right now. OILSEEDS Soybean harvest showing still very good yields out there as well. However, soybean harvest is still relatively slow at 20 % complete from last weekend vs. 35 % average, with modest 10 % advance last week. USDA this morning showed somewhat of a surprise lowering the carryout at 450 mln bu 14/15 for U.S. vs. last month at 475 mln bu based on lower acres harvested, yield increased. World carryout is forecasted at 90.67 mln mt, with s/u ratio at 31.88 %. Market initially wants to rally on this news as potentially could be signs of things to come. In my opinion, with demand staying the same and only cut in harvested acreages and good yield news coming from the field, I think that soybeans are still overpriced. We are talking about a carryout that is nearly 5 times what it was last year and nearly 3 times what we have been trading in the last few years. THIS IS NOT BULLISH beans! China's Golden Week holiday lasted from Oct 1st to Oct 7th was expected to have impact on overall sales and cash activity. However, Export sales this week were pretty healthy as soybeans were 923kmt vs. 500-900 exp., Meal was very strong at 343kmt vs. 150-300 kmt expectations. Brazilian national elections were held over the weekend which ended up in a run-off election that will be held on October 26th. Rousseff and Neves are holding ground, while the business friendly Neves is hopeful he will get support from other candidates to win against left of center leaning Rousseff. Real travelled higher to 2.50 over the weekend and now stabilized at 2.40 level. This and along with rally in futures might cause some further farmers sales but so far has been slow since planting is going relatively slow right now on national level. USDA Ag Attache forecasted China's total oilseed production at 55.8 mln mt, down from 58.7 mln mt in 13/14 down 5 % due to lower peanut and cottonseed crops. Soybean imports are seen at 72 mln mt in 14/15 vs. USDA at 74 mln MT and 69 in 13/14. Executives from a large Malaysian conglomerate this week are forecasting that palm oil prices to average 2,300 - 2,400 ringgit/ ton in late 2014, with 2015 being 2500 - 2600. Current prices are around $ 2200. This development could be supportive to the oilseed complex. Brazilian forecasts now show that only after October 25th will there be any significant rainfall in Brazil's main Center West and southeast ag areas. Sao Paulo also has been extremely dry and their main reservoir expected to dry up by November. Safras this week was estimating that bean planting nationwide is at 3 % complete, which is 1 % behind average and Mato Grosso at 4 % vs. 5 % average; Parana is at 9 % vs. 10 % avg. Pakistan reportedly bought 20-25,000 mt of Australian canola at $ 470 pmt cnf for Jan /Feb shipment. Strategie Grains raised their 2014 EU rapeseed crop to 23.8 mln mt from 23.2 mln mt up 13 % YY. Global giant Bunge reported that estimates are for Ukraine and Russian both to drop in their export veg oil programs this year with ttotal Black Sea veg oil exports at 6.2 mln mt vs. 6.9 mln mt due to drop in sun oil exports. Industry assocation in India is forecasting that oil meal exports in that country will be down 39 % from last year for Sept at 83kmt. USDA Attache also forecasting Argentine soybean 14/15 crop at 57 mln mt vs. USDA's 55 mln mt. Meal spreads continue to drive the oilseed complex higher as CIF Nola beans Oct thru Jan are still at a big inverse of 23 bucks. Given strong scenario for meal demand and slow bean movement, as I had forecasted weeks ago, I still believe the mal and oil will gain on beans and meal spreads in particular will continue to firm.  Although bean cash has been firming, I think that this will be only temporary for now and eventually we will see spreads in beans widen and push futures back down towards $ 9.00 and lower. As I had mentioned a few months ago, crush will continue to be healthy. After this report, this only confirms my forecasts:  Informa CEO Scott was reported in the news this week, having been at Oilseed & Grain Summit in New Orleans, emphasizing next spring would see a quite dramatic shift of acres from fewer corn to more soybeans as they estimated a few weeks ago. I was at the Summit myself so it was interesting to see them agree with my earlier assessment that bean prices need to significantly come down in price relative to corn (or corn rally to bean prices) in order to change this scenario going into 2015/16 season. BOTTOM LINE: I think that the bounce for soybeans is temporary and should not be bought but sold; cash for soybeans and meal is pretty tight given strong export demand through the world, so I would not wait to put on coverage for OND, JFM right now. Look for meal flat price and spreads to firm into 2015. LIVESTOCK: No big surprises here in the USDA report. As I have been mentioning over the last few weeks, processors margins in hogs have been very good and probably will continue to perform well, so see no reason to keep prices where they are right now especially as we progress into 80 % of rest of corn and bean harvest. No major cash trade in cattle is also putting upside ceiling and technically this market looks overbought. Keep selling cattle and hogs in spreads and outright! Nov feeders target 225, Dec fats target at 158 and hogs down to 86 target. BOTTOM LINE: Spreads and cash trade not supportive to long-term rally, would like to be short the markets at these levels. COTTON: Initial reaction to the USDA report cutting U.S. production and carryout to 4.9, but let's keep the focus, people. World carryout is forecasted at 107.11, that is 94.2 % stocks to use ratio. What are we doing here at 65 cents still? Have no clue, probably a function of slow harvest and manipulation, etc. etc. BOTTOM LINE: Stay short until you get to 50 cents, probably roll the short into 2015 for downside of 40. SUGAR: BOTTOM LINEl: Weakness in these markets is an opportunity to buy spreads or outrights. COFFEE: BOTTOM LINE: Close above $ 220.00 has higher targets to 255-260 levels. Market will be too volatile to trade on outrights. We are trading spreads for reduced exposure with still upside potential and profitability. COCOA: Talking with experts in the field gave me impression that cocoa has made its top recently. Losses in production in Indonesia is being replaced with expansion in the New World so could head lower. We don't have an active trade in this market, but will send out market signals when one is ready. MARKET RECAP: LONG WHEAT, SHORT CORN, SHORT BEANS, LONG MEAL (LONG CRUSH) SHORT LEAN HOGS, SHORT FEEDER CATTLE, SHORT LIVE CATTLE LONG COFFE AND SUGAR, SHORT COTTON Source: InsideFutures.com | | Comments: 0 Views: 157

|

|

© 2002—2024 IKAR. Institute for Agricultural Market Studies 24, Ryazansky str., off. 604, Moscow, Russia Tel: +7 (495) 232-9007 www@ikar.ru |

|

|

|

Language: Russian Google translate: