|

|

||||||||

|

|

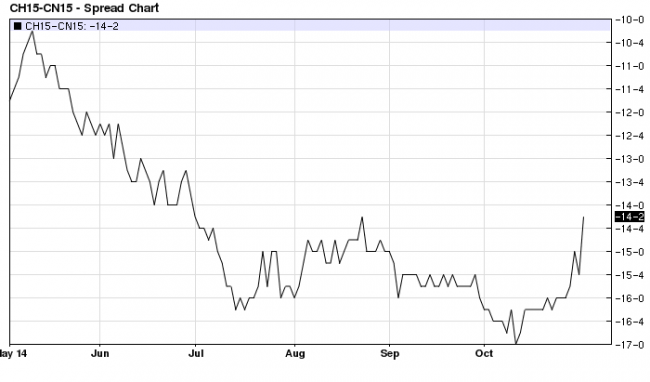

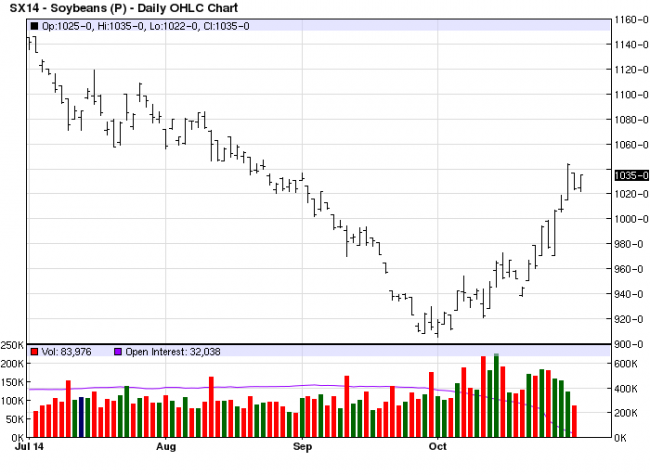

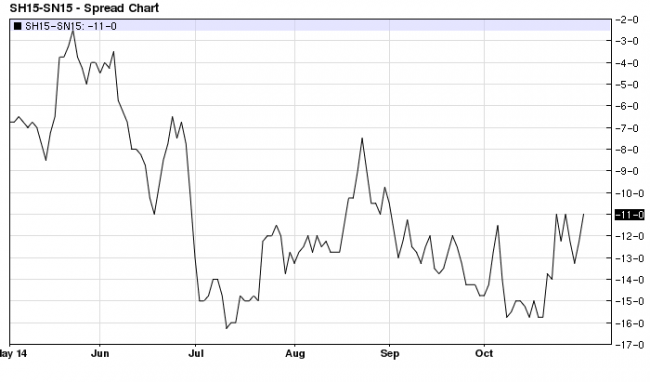

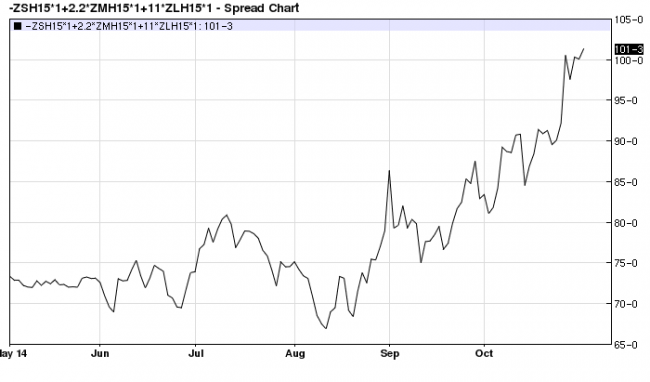

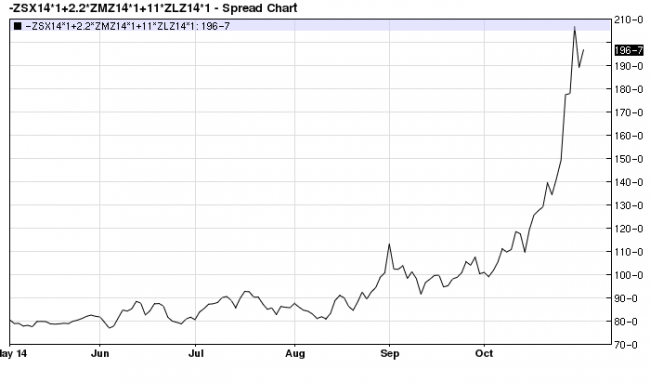

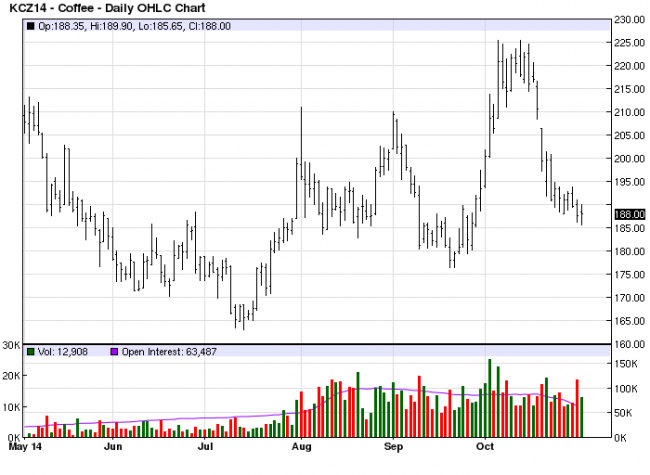

IKAR in Mass MediaWeekly Market Review - Alpine Trading LLC12 ноября 2014 года As for the markets, WHEAT Market has been steady this week and has been able to keep up with the jump in corn prices. We still see support overall as weather conditions in Australia and Russia are still friendly. Logistics are still a nightmare for internal transportation in both U.S. and Canada and we see Black Sea markets not sliding any more but rather rallying with the help of Russian government intervention. Along with that, there are plenty of world buyers coming into the market this week that made actually purchases and not just kicking tires. This afternoon, we are even seeing GASC come into the market for December shipment. Russian wheat prices were up $ 5.50 per ton from last week for 12.5 % protein according to SovEcon, quoted at $ 243 pmt. Shallow water ports were up $ 4.50 pmt at $ 212.50 pmt, while IKAR was quoting prices up $ 7 pmt to $ 244 fob basis. There are concerns that current weather could force winter wheat into dormancy early. This is turn could be supportive to wheat market for next few months. News of the first British shipment of feed wheat to the U.S. in 2 1/2 years also shook up the markets this week. The purchase was made by Murphy Brown, a subsidiary of Smithfield Foods, a hog producer, to help the production of a specific type of meat. This was reportedly only 1-2 cargoes so far which would not be a big impact, but the fact is that rail logistics right now as so backwards that they cannot deliver wheat to the Southeast at cheaper price (or at all) vs. import UK feed wheat. This is very concerning. French wheat delivery silos are full of feed wheat too, so we might see more of this business. As I mentioned several weeks ago, milling wheat is becoming more scare in open market vs. feed wheat. U.S. Winter wheat conditions were 59 % good to excellent vs. 61 % last year. Argentine winter wheat harvest right now is estimated to be 5.2 % complete according to the Buenos Aires Grain Exchange with an estimated harvest of 11.5 mln mt. Argentine FOB prices currently are about $ 45 pmt discount to U.S. HRW prices at the Gulf. This becomes a really good value vs. the U.S. and Canadian for blending purposes. I am definitely recommending to wheat importers/ buyers to take a hard look at Argentine 12 pro wheat for blending purposes especially with an expected fairly good quality crop this year. Argentine newspaper La Nacion is saying that the government may authorize a total of 2 mln mt of wheat exports for 14/15 harvest. This helped to temper the rally in the wheat markets this week of course since Argentina is expected to become a sizable exporter this year with 6 mln mt forecasted so far. Since Brazil is expected to import 6 to 6.5 mln mt, I would suspect that the majority of the Argentine exportable surplus will go to Brazil. Foreign reserves in Argentina continue to fall, now at $ 237.37 billion, so it is extremely important for the economy that Argentina does have those export permits issued for total of 6 mln mt for 14/15 crop. Of course, we have seen the Argentine government do some very stupid things in the past. Tunisia bought 150,000 mt of optional origin durum wheat at 540-581 usd pmt cnf. India also bought 12,000 mt of Aussie wheat $ 310-315 pmt CNF. South Korea also tendered for 23,100 mt of U.S. wheat. Algeria also bought 300,000 mt of durum wheat in their tender last week between $ 545 ton and $ 582-590 pmt CNF from Mexico and Canada for spot up to Apr/May shipment. Jordan extended their deadline to buy 100,000 mt of milling wheat. Japan also tendered for feed wheat and barley. Taiwan bought 41,250 mt of U.S. wheat for Dec/Jan including 21,100 mt of northern spring at $ 361.30/ ton, 12,250 mt of HRW at $ 293.76 pmt and 7900 mt sww at 278.72 pmt. Bangladesh also confirmed that they would buy 250,000 mt of Ukrainian wheat at $ 297.50 pmt cnf. USDA Attache lowered Australian wheat production to 24 mln mt due to low rainfall, below the USDA's 25 mln mt forecast. Other analysts are more aggressive to cut production forecasts to 22-23 mln mt because of current unfavorable weather. Indian government has raised its intervention price for new crop wheat in the local market by 3.57 % encouraging supply even this has exceeded demand for eight years now. IGC raised their forecast for 2014/15 global wheat crop by 1 mln mt to record 718 mln mt, while overall use has gone up to 710 mln mt up 1 mln mt from last year. Export sales this week were at 444,900 mt vs. 300-375kmt expectations, with the main destinations for the sales being Japan, Mexico, Brazil and the Philippines. BOTTOM LINE: I continue to believe we have higher levels in wheat ahead for the overall complex, so be diligent to buy futures on breaks and put on coverage for N/D and JFM even A/M now. We also see Argentine wheat being a very good value at $ 245-250 pmt for 12pro for blending purposes for Jan / Feb shipment periods. This is about $ 50 pmt discount to U.S. HRW values! CORN The corn futures market had an excellent rally this week picking up about 20 cents as of todayl on the board and still showing some resilience at these levels. However, as we expect to get further into U.S. harvest and into Argentine planting we could see this rally temper. Export sales were not that impressive this week based on last week futures levels of $ 3.50 so I cannot imagine $ 3.70 - $ 3.80 will help demand. I believe we have seen a temporary peak. Corn was rated 96 % mature up 3 % from last week vs. 97 % average; Corn harvest is 46 % complete vs. 65 % average, up 15 % from last week. Crop conditions are 74 % G/E unchanged from last week. Down in Argentina, the national average for corn planting is at 34 % complete up 4 % from last week and 31 % last year. Buenos Aires Grain Exchange is currently estimating that corn planting is 35.6 % complete nationwide vs. 32.8 % last wee. Estimated corn area is 3 million hectares. USDA also reported a flash sale of 113,000 mt of sorghum to unknown for 14/15. Earlier this week, USDA reported a flash sale of 101,600 of corn to unknown for 14/15. Export sales this week were at 489,800 mt vs. 700-900kmt expectations, with the main destinations being the traditional ones such as Peru, Colombia, Japan and Mexico. All these buyers have either a freight or tariff advantage to buy U.S. corn right now. However, we still see Brazilian and Argentine corn gaining business into the Med/ North Africa as it remains a discount to the U.S. values. IGC also forecasting corn crop at 980 mln mt for 14/15 up 6 mln mt from last month but below the last year's crop at 983 mln mt which was a record. ADM Germany stating that EU corn harvest is likely to be 73.6 mln mt in 2014, up from 64.3 mln mt last year. As I had mentioned several weeks ago, that my original target for corn was $ 3.00 per bushel in the short to medium term. Given the planting and harvest delays experienced over the last few weeks and persistent export demand for the corn complex in North and South America, it seems unlikely that we reach $ 3.00 right now. In fact, I believe we will start establishing a short-term bottom near $ 3.40. One of the reasons that I mention this is because of what the spring spreads have been doing for 2015. As I mentioned in Sept and early October, March/ July corn is starting to firm. I believe that it will continue to firm until such time that we feel comfortable with South American corn supply:  We have been long these spreads for a few weeks now and will continue to hold them until further notice. BOTTOM LINE: Corn futures right now are overpriced and probably will trend lower as I believe demand will shut off at current levels. Cash corn is undervalued and should be bought for coverage into JFM, but I would hold off for April-forward. OILSEEDS Soybean meal was the star of the grain complex this week as meal and crush spreads were making historic highs as I predicted several weeks ago. As I have been mentioning for some time now, it was a ticking time bomb with excellent export sales week after week back even in Sept and with slow harvest, something had to give. Well, where do we go from here? I think that overall the soybean meal and oil are going to be supported on breaks, however, soybeans probably have overextended themselves to the high side recently. While originally, I was expecting the soybean market to break $ 9.00 per bushel at some point during harvest (especially given the good yields), it is difficult to see that we will get there for the balance of the year with such a STRONG product market. I think if we close above $ 10.32 for SX on the week that could mean higher prices in the short-term, but a close lower than this will mean a break down to $ 9.80 over the coming weeks. Next upside target would be $ 10.83 per bushel. I hate to be uncertain about this prediction but right now it is too volatile to see anything but a move higher.  U.S. Soybean harvest is 70 % complete, up 17 % from last week vs. 76 % average. Buenos Aires Grain Exchange is estimating soybean planting is currently at 4 % vs. 2 % last week. Total soybean area is estimated at 20.6 mln hectares according to them. Big news that could impact oilseed market this week was with Brazilian elections as they re-elected Rousseff by a vote of 51 % of 49 %, after convincing the electorate that the party's strong record of reducing poverty over the last 12 years was more important than ongoing economic slowdown. Real is currently trading at 2.45 with a peak above 2.50 recently. This could help, along with high soybean futures, to get some farmer selling to occur. USDA this week announced through the Ag Attache that they are lowering the Brazilian soybean export estimate to 47 mln mt from 49 mln mt, due to the slow pace of planting as well as the slow pace of farmer sales until now. They are still keeping the production estimate the same at 94 mln mt. This type of change is overall supportive to the futures markets on soybeans. A group of Thai feed millers bought 340,000 mt of meal and 20,000 mt of beans this week for FH 2015 delivery. One cargo of Argentine meal traded at $ 105-110 + smh5 Jan while another 60,000 mt traded at + 90 smh5 for March. They had bought Apr/ May/ June around + 60 over the respectives. Beans traded for June at $ 2.00 over june cnf. There was also noted that the Thai market was also storngly buying DDG's from the U.S. this week. There were many buyers this week in Asia coming out to put on coverage as well for Nov/ Dec and JFM DDG's. Thailand is the 4th largest soybean meal importer in the world with 3.2 mln mt annual volume, next to Indonesia and Vietnam with similar volumes. USDA reported a flash sale of 132,000 mt soybeans to China for 14/15 late this week, while also reporting another 120,000 mt flash sales to China early in the week. Export sales this week were 1.326 mln mt vs. 1.0 to 1.5 mln mt expectations on soybeans while 147,800 mt total sales vs. 150-300kmt expectations. The main destinations for the beans were China (1.05 mln mt), Japan, Portugal and Egypt for soybeans while for soybean meal, the sales were for Mexico, Italy and Venezuela. Argentine newspaper La Nacion is reporting that the government is reducing loan availability to farmers. The idea being that by reducing capital availability to the farmers, this will force them to sell soybeans to finance their crop and inputs. This could eventually impact the new crop planting which will be going on in the next few weeks. Somar said yesterday that rains they've seen will stop losses in early planted soybeans and corn and will accelerate new planting in Brazil. Currently Safras estimated Brazilian soybean planting advanced 5 % to 12 % complete vs. 31 % average and 26 % last year. AgRural estimated planting at 16 % complete up 6 % vs. 34 % last year. Bunge's CEO stating that oilseed crushers will profit from strong U.S. soybean crushing margins through the beginning of next year as demand for livestock producers and importers remains strong. He sees strong margins lasting at least 6 months as demand for U.S. curshing capacity is real and it will stay with us for quite a while. Mistry estimated that palm oil prices will rise to 2,500 ringgit by March as output eases. Prices are seen trading between 2,100 to 2,300 over the next few weeks then firming into March 2015. Indonesia and Malaysia palm oil production has been lowered which gives ideas that stocks will peak this month and gradually decline into 2015. Also, Malaysia said that they will impose 7 % palm biodiesel blend in stages starting in November 2014. The program will consume 575,000 mt of biodiesel per year and will save up to 667.6 mln liters of diesel / year. CME raises margins on Soybean meal futures from $ 1650 to $ 2200 for spec traders and $ 1500 to $ 2000 for hedgers due to volatility and higher prices. IGC also forecasting that EU rapeseed crop (world's biggest) for 14/15 would be negatively impacted and that winter sowings in Ukraine right now are 95 % of what they are normally. Last year EU produced 23.8 mln mt of rapeseed, but IGC this year forecasts a drop of 4 % from previous crop. NO NOVEMBER SOYBEAN DELIVERIES YET! So it is very possible that we go higher on the soybean futures. I think that with any weather market, it will be extremely volatile. As a speculator, I would play in the spreads such as we have been in the March/ July 2015 for a few weeks now:  Upon my recommendation, we exited early the positon for our soybean meal bullspreads and crush spreads however, it was difficult to judge where this market was heading. Now that we have one solid strong week behind us, I have a better idea on plan of attack from now on. Also, given the tight logistics we have right now before the winter time frame in the U.S., given the bullish crush comments by the industry, as well as slow planting and possibly South American crops, we will possbily see the March crush really take off from current levels:  Compare the March crush to the current Dec crush  So conceivably, we could see March crush almost double if we believe December crush is any to where it could go. World buyers are already covering into 1Q and 2Q 2015 for meal purchases right now. Feb/ March time frame is very early for Brazilian and Argentine crops to put a dent in the demand for products with new crop, especially if the plantings are behind schedule. If we believe that logistics are bad now, they could only get worse into Jan/ Feb 2015 when winter weather starts to typically worsen for the crushing in dustry in the U.S. BOTTOM LINE: Meal coverage from now until April/ May 2015 in the cash markets is important and I hope that you have been listening to my recommendations. Buy futures in meal and beans on break. For more information on how to implement a specific plan, give me a call. LIVESTOCK: Given a strong corn and meal complex, it is difficult to be overly bullish the livestock complex right now. We covered our shorts in the hog bearspreads for a profit a little bit early last week but nonetheless, I still believe that the big inverses in live cattle market still have some more downside in them while hogs will stabilize relative to the cattle. BOTTOM LINE: The two main livestock markets could slip further, but I would prefer to be long hogs vs. short cattle at this point relative to historical values posted recently. COFFEE Widespread rains are due to move into Brazil's drought-damaged coffee and sugar belts this weekend bringing relief to high temperatures, said Somar, local forecaster. Longs (in the spreads like myself) have been suffering because of this change of Mother Nature's plans. However, with that being said, I believe that the damage to the Brazilian has been done even if tempered by recent rains and that we will only start to see this damage in the months to come. I will still hold on to coffee spread length until further notice given these historically cheap levels right now, downside is in my opinion minimal. Starbuck's this week also mentioned that they still lacked coverage for the 1/3 of balance of their fiscal year 14/15 claiming that they are not worried about potential problems of higher prices. Well, what do you expect one of the largest buyers in the world to say when it could impact their bottom line? That we are scared coffee will go to $ 3.00? Of course, not. This current market warrants some patience.  BOTTOM LINE: Hold onto to bullspreads in coffee with optimism that long-term effects will show their heads in the next few months. We might need to roll positions forward close to expiration. COTTON Turkey is launching a probe into possible dumping of U.S. cotton in the country, which is a sign of rising tensions with sinking world prices. Currently, no change in opinion, as the dollar is rallying in a big way, this help to prompt a further slide in cotton prices although recently it has been range bound. BOTTOM LINE: Hold on to shorts for time being as optimistic we will see a slide into the 50 territory before Christmas. SUGAR The current weather forecast for Brazil is still helpful to the developing crop there. However, ABN recently came out with comments that the crop damage to Brazilian crops and potential El Nino effects could be supportive to the overall sugar market. They are targeting a $ 18.50 level by April 2015. My current thoughts are to stay the course long the sugar spreads in this market, as we have gotten now to critical levels that I believe these price levels will impact origination from the farm in the major producing regions of the world. BOTTOM LINE: Maintain length in the sugar spreads 2015. COCOA I had not made any specific predictions in the last several weeks in cocoa, but here is one for you. As I stated a few weeks ago, the Ebola virus risk was overblown and we decided rightly so to take profits on the bullspread during the scare. I did not establish any positions in that market as was not sure of the direction except that my industry contacts had told me that the loss of production in key areas was being replaced by non-traditional suppliers and exporters. So we definitely see downtrend forming right now and are at critical levels to break support especially with dollar flying high today. BOTTOM LINE: Short Cocoa with value target to $ 2650 (ABN also released forecast to $ 2750 this week). Source: InsideFutures.com | #grain | Comments: 0 Views: 141

|

|

© 2002—2025 IKAR. Institute for Agricultural Market Studies 24, Ryazansky str., off. 604, Moscow, Russia Tel: +7 (495) 232-9007 www@ikar.ru |

|

|

|

Language: Russian Google translate: