|

|

||||||||

|

|

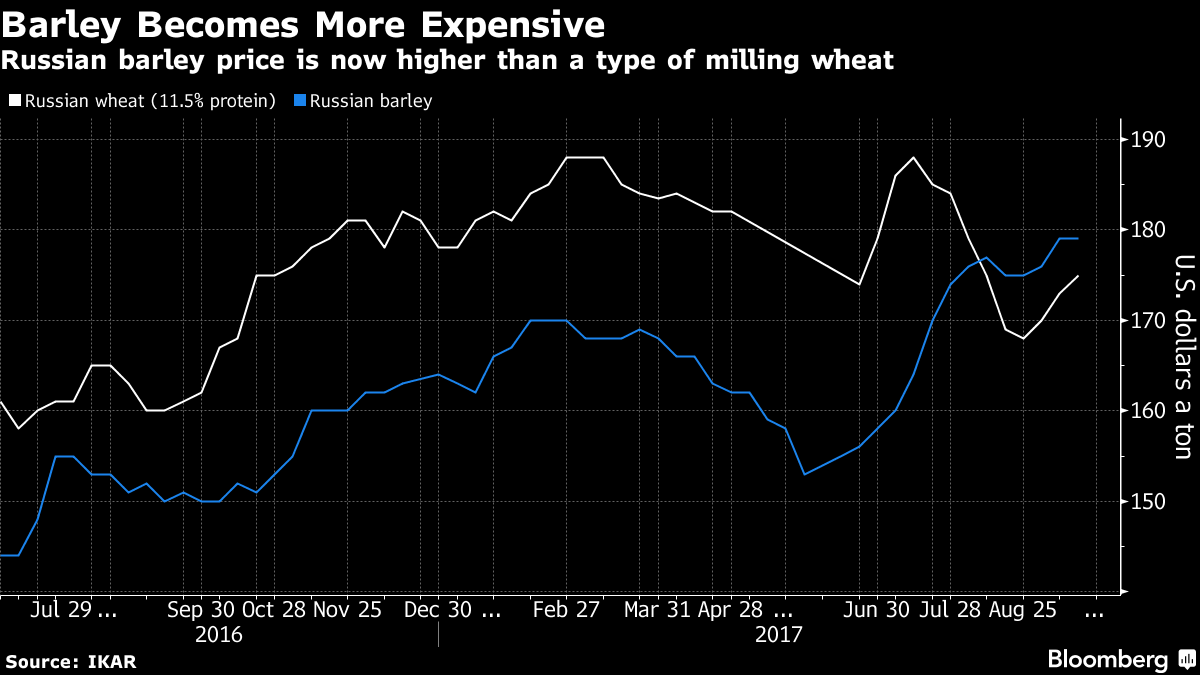

IKAR in Mass MediaRussia Grabs More of Barley Market as Supplies Dip Elsewhere22 сентября 2017 года Smaller barley harvests from Europe to Australia are helping Russia offload its bumper crop faster than anywhere else. Russian exports of the grain used mostly for animal feed surged 60 percent so far this season, government data show. For the whole of 2017-18, the country’s sales will jump more than any other major shipper, while global exports fall to a four-year low, according to the U.S. Department of Agriculture.  World output is falling, partly as dry weather hurt crops in Australia and a heat wave was followed by heavy rains in parts of the European Union, the top two exporters. With the market heading for a second consecutive shortfall, global inventories will shrink to their lowest level in more than three decades. That’s giving top producer Russia a chance to grab more of the export market after its crops benefited from ample rains. “Russia has been the only barley exporting country that was able to significantly increase its production in 2017,” said Stefan Vogel, head of agricultural commodities research at Rabobank International in London. “Thus, exports are flowing at a much stronger pace.” While global output will decline 4 percent to 142 million metric tons this season, Russia’s harvest will increase 17 percent to a nine-year high of 20.5 million tons, USDA data show. Government data shows the nation has already shipped out 1.6 million tons since the season began in July, which is about 35 percent of the USDA’s forecast for the entire year. Most of the exports have gone to Saudi Arabia, Iran and Turkey, which are traditionally some of Russia’s biggest customers, according to consultant ProZerno. Demand for Russian barley has helped prices reach the highest since 2015 and exceed those of low-quality milling wheat for the first time in at least a year, according to the Institute for Agricultural Market Studies. At $179 a ton, barley was at a premium of about $4 to wheat with 11.5 percent protein content for export from Novorossiysk as of Sept. 15. That compares with an average discount of about $15 over the past year.  Still, the rare premium over wheat means barley prices probably won’t rise much more, said Marina Sych, an analyst at UkrAgroConsult. Russia isn’t the only country to see a fast start to this season’s barley exports. Shipments from the U.K. jumped in July, with the biggest sales to Spain, which suffered from a poor local crop. Source: Bloomberg | #grain | Comments: 0 Views: 76

|

|

© 2002—2025 IKAR. Institute for Agricultural Market Studies 24, Ryazansky str., off. 604, Moscow, Russia Tel: +7 (495) 232-9007 www@ikar.ru |

|

|

|

Language: Russian Google translate: